NOTIFICATION NO. 28271 GDT DATED 15 AUGUST 2023 ON “ADJUSTMENT OF THE SPECIFIC TAX RATE ON LOCALLY MANUFACTURED NON-ALCOHOLIC BEVERAGE PRODUCTS”

The Specific Tax rate for non-alcoholic beverages produced and supplied locally will be adjusted and determined as follows, effective 1 September 2023:

- 15% on all types of energy drinks

-

5% on the following non-alcoholic beverages:

- UHT milk supplement drinks

- Soy milk

- Coconut-based drinks

- Coffee-based beverages and coffee-flavored beverages

- Non-carbonated beverages that are ready for consumption without dilution

- 10% on all other non-alcoholic beverages except those specified in (1) and (2) above.

Separately, the Specific Tax base must be implemented as it is being done currently in accordance with the contents of Prakas No. 012 MEF.PrK dated 14 January 2020 for the Adjustment of Determining the Specific Tax Base on Certain Domestically-Produced goods.

二重課税防止協定 (カンボジア-韓国)

한-캄보디아 양국 간 기업투자 및 교류를 촉진하기 위해 2019.11.25. 서명한 조세조약(이중과세방지협정)이 2021.1.29.부터 정식 발효*되었습니다.

* 우리나라는 2020.12.9. 국회 비준동의를 얻어 국내절차 완료, 2020.12.30. 캄보디아 정부로부터 국내절차 완료를 통보받아 1.29일자로 정식 발효

- 2022.1.1. 이후 발생하는 소득 분부터 동 협정 적용

ㅇ 동 조세조약 발효로 우리나라가 아세안(ASEAN) 10개국*과 체결한 모든 조세조약이 발효되었습니다.

* 라오스, 말레이시아, 미얀마, 베트남, 브루나이, 싱가포르, 인도네시아, 캄보디아, 태국, 필리핀(가나다순)

□ 한-캄보디아 조세조약의 주요 내용은 다음과 같습니다.

① (사업소득) 현지 고정사업장*에 귀속되는 소득만 소득발생지국에서 과세 가능(조세조약 미체결 시 사업장 유무와 관계없이 과세 가능)

* 사무실, 공장, 지점, 건설현장(9개월 초과 지속), 자원탐사 및 개발(6개월 초과 지속) 등

② (건설 고정사업장에 귀속되는 소득) 건설활동 수행 시 과세대상 사업소득의 범위를 규정하여 건설현장의 고정사업장에 귀속되는 활동만이 과세대상이 된다는 점을 명시

③ (배당·이자·사용료소득) 기존 캄보디아 세율보다 낮은 세율을 적용토록 하여 우리 진출기업의 현지 세부담 경감

* 캄보디아 국내세율 14% → 조약상 적용가능한 최고세율 10%

④ (국제운수소득) 국제항공소득은 기업의 거주지국에서만 과세 가능하고, 국제해운소득은 소득발생지국에서 과세 가능하나 50% 감면*

* 조세조약 미체결 시 캄보디아 국내세율 14% → 체결후 7% (50% 감면)

⑤ (간주외국납부세액공제 허용) 캄보디아가 외국인투자 활성화를 위해 우리나라 기업이 캄보디아에서 납부할 세금을 감면할 경우 감면된 세액에 대해서 한국에서 외국납부세액공제를 허용*

* 한-캄보디아 이중과세방지협정 발효 후 10년간 유효

⑥ (조세회피 방지) 조세조약에서 정하는 낮은 세율 등의 혜택을 주목적으로 하는 거래에 대해서는 그 혜택 배제 가능

⑦ (조세협력 채널 신설) 과세당국 간 상호합의, 조세정보교환, 징수협조 등

□ 이번 조세조약은 우리 국민들에게 조세분야에서의 혜택을 부여하는바, 한-캄보디아 간 투자 등 경제교류가 보다 활성화될 것으로 기대됩니다.

Prakas No.430 on Launch of public services related to the Labor and vocational trainning sector via automation system

Prakas No.430 on Launch of public services related to the Labor and vocational trainning sector via automation system

Prakas No. 433 on Agreement between Occupational safety and Health Department and Health Facilities...

Prakas No.433 dated 31 December 2020 on Agreement between Department of Occupational Safety and Health and Health Facilities to Provide Medical Examination services to Cambodian Workers.

Prakas No. 429/20 K.N/Br.K date of 31.December 2020

Prakas No. 429/20 K.N/Br.K date of 31.December 2020

Payment of back pay seniority indemnity before 2019...

1. Payment of back pay seniority indemnity before 2019

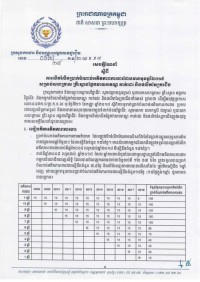

Prakas No. 009 of MoEF: Classification of Taxpayers

|

Taxpayers |

Classification criteria |

|

|

Prakas No. 025 (Previous) |

Prakas No.009 (New) |

|

|

Small |

. Annual turnover from KHR 250M to KHR 700M (~US$ 62,500 to US$ 175,000) . Three consecutive months turnover or expected three consecutive months turnover more than KHR 60M (~US$ 15,000) within the calendar year. . Sole proprietorship or partnership and . Participation in any bidding or quotation for supply of goods services |

. For taxpayers in agriculture, service and commercial sectors: annual turnover from KHR 250M to KHR 1,000M (~US$62,500 to US$250,000) or; . For taxpayers in industrial sector: annual turnover from KHR 250M to KHR 1,600M (~US$62500 to US$400,000) or; . Three consecutive months turnovers or expected three consecutive months turnover more than KHR 60M (~US$15,000) within the calendar year; or . Sole proprietorship or partnership; or . Participation in any bidding or quotation for supply of goods or services. |

|

Medium |

. Enterprise with annual turnover from KHR 700M to KHR 4,000M (~US$175,000 to US$1,000,000); . Enterprise which are incorporated as legal entitles, representative offices; . National and sub-national government institutions, all types of organizations or association including governmental organization and; . Foreign embassies and consulates, international organizations and technical cooperation agencies of other counties. |

. For taxpayers in agriculture sector: Annual turnover from KHR 1,000M to 4,000M (~US$250,000 to US$1,000,000) . For taxpayers in services and commercial sectors: Annual turnover from KHR 1,000M to 6,000M (~US$250,000 to US$1,500,000) or; . For taxpayer in industrial sector: annual turnover from KHR 1,600M to KHR 8,000M (~US$400,000 to US$2,000,000) . Enterprise which are incorporate as legal entitles, representative offices; or . National and sub-national government institutions, all type of organizations or associations including non-government organizations; or . Foreign embassies and consulates; international agencies of other countries. |

|

Large |

. Enterprises with annual turnover above KHR 4,000M (~US$1,000,000) . Subsidiaries of multinational companies, branch of foreign companies; and . Enterprise registered as Qualified Investment Projects. |

. For Taxpayers in agriculture sectors: annual turnover above KHR 4,000M (~US$1,000,000); or . For taxpayer in service and commercial sectors: annual turnover above KHR 6,000M (~US$1,500,000); or . For taxpayers in industrial sector: annual turnover above KHR 8,000M (~US$2,000,000) or; . Subsidiaries of multinational companies, branches of foreign companies; or . Enterprise registered as Qualified Investment Projects. |

Cambodian Labour Law includes all the amendments from 1997 to 2018

Cambodian Labour Law includes all the amendments from 1997 to 2018

Sub-Decree on Business Registration through Information Technology

Automatic business registration at MOC, GDT, MOL and CDC for new company registration

Inter-Ministerial Prakas on Public Service Price Adjustment of the Ministry of Commerce:របស់ក្រសួងពាណិជ្ជកម្ម

Inter-Ministerial Prakas on Public Service Price Adjustment of the Ministry of Commerce

Circular on the exemption of seniority allowance tax from 2020

Circular on the exemption of seniority allowance tax from 2020

សេចក្ដីណែនាំស្ដីពីការរំលឹកប្រាក់បំណាច់អតីតភាពការងារដែលមានមុនឆ្នាំ២០១៩ សម្រាប់សហគ្រាស គ្រឹះស្ថានផ្នែកវាយនភណ្ឌកាត់ដេរ និងផលិតស្បែកជើង

សេចក្ដីណែនាំស្ដីពីការរំលឹកប្រាក់បំណាច់អតីតភាពការងារដែលមានមុនឆ្នាំ២០១៩ សម្រាប់សហគ្រាស គ្រឹះស្ថានផ្នែកវាយនភណ្ឌកាត់ដេរ និងផលិតស្បែកជើង

សេចក្ដីណែនាំពីការទូទាត់ប្រាក់បំណាច់អតីតភាពការងារថ្មី ក្នុងឆ្នាំនីមួយៗ ចាប់ពីឆ្នាំ២០១៩

សេចក្ដីណែនាំពីការទូទាត់ប្រាក់បំណាច់អតីតភាពការងារថ្មី ក្នុងឆ្នាំនីមួយៗ ចាប់ពីឆ្នាំ២០១៩

720 mef Tax Audit 20190313

On 13 March 2019, the Ministry of Economy and Finance (“MEF”) issued Prakas 270 on Tax Audits (“Prakas 270”), which attempts to streamline the tax audit process, as part of the government’s large-scale economic reforms, to improve transparency in tax payments and collections, and promote a fair and competitive business environment.

The three types of tax audits (desk, limited, and comprehensive) defined in the Law on Taxation (“LOT”) and Prakas 1059 on Tax on Profit remain unchanged. However, more robust criteria on how each type of tax audit is carried out have been set out in the Prakas on Tax Audit, as follows:

Sub-Decree 17

The Sub Decree aims at putting forward the tax incentives of the Royal Government as a contribution to the development of the small and medium-sized enterprises through voluntary registration for tax.

This Sub Decree defines the tax incentive mechanism to be provided to small and medium-sized enterprises for encouraging them to voluntarily register themselves for tax in order to create a transparent and equitable tax system.

Prakas on Minimum Wage 2019

From 2019, USD 5 shall be added to the minimum wage to make it USD 182 per month. And USD 177 for probationary workers/employees.

Prakas 464 Taxation for NGOs

The Prakas aims at strengthening tax compliance of associations and non-government organizations in the Kingdom of Cambodia.

The objective of the Prakas is to provide further instruction in tax compliance of associations and NGOs in compliance with the applicable taxation laws and regulations and the Law on Associations and NGOs to ensure efficient and effective implementations.

The Prakas applies to associations and NGOs conducting their activities in the Kingdom of Cambodia.

Prakas 361

The Prakas is aimed at providingexempted VAT for basic daily foodstuffs so as to ease the people daily livingstandards.

The Prakas is set to determine somespecific basic foodstuffs subject to the exempted VAT.

The Prakas isapplied for self-assessment regime taxpayers locally carrying out basicfoodstuffs supplies for the people in the Kingdom of Cambodia.

Prakas 258 MOC Recognition of Legal Representative in Applying for Business Registration

This Parkas sbjectives to manage and strengthen capacity for legel representative of enterprise and company.

National Social Security Fund 2014

NSSF has compiled their policy and Royal Decree-Code-Prakas, etc., for their work implementation.

National Social Security Fund 2013

NSSF has compiled their policy and Royal Decree-Code-Prakas, etc., for their work implementation.

Law on Nationality

The Law onNationality, which was adopted by the National Assembly on 31 May 2018 duringthe 10th Session of the Fifth Legislature, and thoroughly examinedby the Senate on 11th June 2018 during the 01st PlenarySession of the Forth Legislature, and which covers as follows:

TheLaw is aimed at ensuring the exercise of the jurisdictional procedures of the Kingdomof Cambodia for a person to determine the eligibility and the renouncer ofKhmer nationality for those living in Cambodia or abroad and fulfilling theconditions required by the law.

Law on Management of Private Medical, Paramedical, and Medical Aide Practices

The purpose of this Law is to define procedures and conditions of functioning for management of private medical, paramedical, medical aide profession in the Kingdom of Cambodia.

Shall be considered as:

- Medical professionals and Paramedical professionals are those of physicians, pharmacist, dentist and midwife; and

- The medical aide professionals are nurses, laboratory specialist, physical therapist, dental specialist, and similar professional practitioners

The professional similarity as mentioned in the above paragraph shall be stipulated by Sub-decree (Anukret).

Law on Management of Pharmaceutical (1996)

The objective of this law is to govern all pharmaceuticals in the Kingdom of Cambodia.

A pharmaceutical is one or many kinds of substances which are primarily from chemicals, bio-products, microbes, plants combined in order to:

- use for prevention or treatment of human or animal diseases,

- use for medical or pharmaceutical researches or diagnosis,

- change or support the functioning of the organs

Inter-Ministerial Prakas on Cambodia Foreign Worker Inspecion Enhancement

Hereby the prakas of INTER-MINISTERIAL PRAKAS On CAMBODIA FOREIGN WORGER INSPECTION ENHANCEMENT.

For more detail please checked in attached file: Eng & KH Version..

Eng_ROYAL KROM_The Amendment the Article of the Labour Law

The Law on the Amendment of Article 87, Title "C", Section 3 of Chapter 4, Article 89, Article 91, Article 94, Article 110, Article 120, and Article 122 of the Labor Law, are hereby promulgated by the Royal Code.

20180921_443_announced

This prakas is start from 2019:

For more detail please kindly check Khmer & English Version in attached file.

20180921_442_announced

From January 2019, all owners? of institution who are the subject of the provisions of the Labor Law shall arrange salary payment to employees 2 times per month.

- 1st (2nd week of the month) : 50% of Basic Salary / Month

- 2nd (4th Week of the month): The remaining salary include other benefit and allowance / month.

028-18-Khmer-Notification of Requesing Quota and Extend Work Card 2019

028-18-Khmer-Notification of Requesing Quota and Extend Work Card 2019

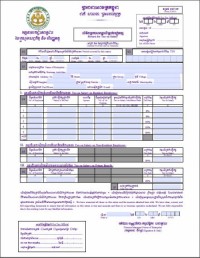

3-TOS_F_20180117

Implementation of Tax on Salary changes

As most readers are aware salary income that is received by an employee working for a tax registered employer in Cambodia is assessed on a monthly basis for Tax on salary. For tax resident taxpayers, tax on salary is applied at progressive rates from 0% to 20%, which are applied by tranche of monthly taxable salary. The current monthly tax on salary rates for tax resident employees in Cambodia is set out below. (Assume: 1 USD = 4,000 riels).

Law on Amendment of Law on Pharmaceutical Management

Law on Amendment of Law on Pharmaceutical Management

2018년도 연간 법인세 (Annual Profit Tax Return) 구비서류안내

2018년도 1월부터 3월 31일까지는 연간 법인세 신고 기간입니다.

원활한 신고를 위해 2월 초까지 전년도 구비서류내역 제출해 주시기 바랍니다.

자세한 구비서류 내역은 첨부파일을 참조하시기 바랍니다.

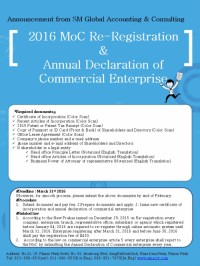

Annual Tax Return 2016 & Renewal Patent 2017 Announcement

Annual Tax Return 2016 & Renewal Patent 2017 Announcement

Circular No.011 MEF: Latest Developments in Fringe Benefit Tax superseded circular 002 of 2015

On 6 October 2016, the Ministry of Economy and Finance issued Circular No.011 MEF entitled "The Implementation of Withholding Tax on Fringe Benefits". It supersedes Circular 002 MEF dated 20 January 2015, and now applies all Businesses not just manufacturing businesses. The 2016 Circular describes certain cash or in-kind employee benefits that are not subject to Fringe Benefit Tax (FBT). These are as follows:

1. Transportation allowance or transportation from the workers' or employees' accommodation to the factory or workplace, and vice versa, and housing allowance or accommodation to the factory complex, subject to any limitation under the labor law.

2. Provision of meals or meal allowances if these are provided to all employees and workers regardless of their positions or functions

3. National Social Security Fund or Social Welfare Fund contributions up to the level determined by the Labor Law

4. Health insurance or life and health insurance permiums fi these are provided to all employees and workers regardless of their positions or functions

5. Child allowance or child-care center expenses meeting the requirements of the Labor Law

6. Compensation for redundancy or termination not exceeding the amounts provided foro in the Labor Law

These exemptions are identical to those contained within the superseded Circular 002 of 2015; however under Circular 002, it was generally understood that they applied only the garment and footwear factories. The new 2016 Circular contains a significant difference in its introductory paragraph, which staes that it applies to "workers and employees of all factories or enterprise." Thus, it now appears that the exemptions will apply to all enterprises, which will be of great interest to other manufqacturers, as well as banks, insurance companies, hotels, and all other non-manufacturing enterprises.

Although neither Circular 002 of 2015 nor the new 2016 Circular restricts the applicability of the exemptions to only cambodian personnel, a ruling letter issued in 2015 to the Garment Manufacturers Association of Cambodia stated that the FBT exemptions applied only to Cambodian nationals. It is probably safe to assume for the moment that this restriction still applies.

If you have any questions about this issue, or would like to discuss how it may be of benefit to your business, please contact Mr. Lee Sang Yeop (sylee@smacct.com), or your regular SM Gobal consultant.

PROPERTY TAX PAYMENT FOR 2016

According to Notifications No. 12723 dated 5 August 2016 and No. 13466 dated 16 August 2016 issued from GDT (General Department of Taxation) owners of immovable property shall pay the property tax to the tax authorities by 30 September 2016. Late payment and default are subject to penalty and additional tax.

Announcement of the Ministry of Economic and Finance

As per Notification No. 039 issued by the Ministry of Economy and Finance (MEF) on 21 July 2016, a working group consisting of representatives from both the General Department of Taxation (GDT) and the Phnom Penh Municipality will begin to collect data from all enterprises in Phnom Penh from August 2016 onwards.

2016 MoC Re-Registration & Annual Declaration of Commercial Enterprise

1. According to the New Prakas issued on Decmeber 29, 2015 on Re-registration every company, enterprise, branch, representative office, subsidiary or agency which registered before January 04, 2016 are required to re-register through online automatic system until March 31, 2016. Enterprise registering after March 31, 2016 and before June 30, 2016 shall pay the registration fee of $430

2.According to the law on commercial enterprise article 5 every enterprise shall report to the MoC by submitting the Annual Declaration of Commercial enterprise every year.

Tax Re-registration (Update Information)

캄보디아 세무전산화 등록 관련하여 중앙 세무서에 2015년 4월 27일자로 공문을 발송하였습니다.

간략한 내용은 “모든 법인의 대표는 법인 서류를 구비하여 세무서에 출석하여 사진 및 지문을 등록해야 합니다.

지역과 함께 쑥쑥 동행하는 SM

캄보디아 Kampong Spue에 위치한 JOY FAUNTAIN FOUNDATION은 아이들의 맑은 웃음으로 가득합니다. 2007년 캐나다 영락교회 후원으로 설립 된 JFF는 캄보디아 어려운 아이들과 고아들을 돕기 위해 만들어진 센터입니다. 현재 32명의 천사들이 살고 있으며, 선교사님들과 자원봉사자들 그리고 이름없는 천사들의 후원으로 운영되고 있습니다. 또 올해는 중학교에 가는 천사도 있고 무척이나 기쁜 일이 가득하답니다 : )

| No. | Title | Attach. | Date |

|---|---|---|---|

| 1 | Prakas on Wage Payment for Workers/Employees | 14-01-2019 | |

| 2 | VAT Prakas for Supporting Industry of Garment Industry | 06-08-2015 | |

| 3 | Law on commercial arbitration (Kh) | 04-06-2014 | |

| 4 | Law on employment 1(Kr) | 04-06-2014 | |

| 5 | Law on employment 2(Kr) | 04-06-2014 |

| No. | Title | Date |

|---|---|---|

| 1 | How can I get to SM Global? | 04-06-2014 |